New Report on Medical Negligence Claims*

Hanahoe and Hanahoe’s team of medical negligence solicitors, welcome the findings of a new report on medial negligence claims* and their management. The Expert Group Report to Review the Law of Torts and the Current Systems for the Management of Clinical Negligence Claims chaired by Mr Justice Charles Meenan, published their report on the 16th December 2020. Our team of medical negligence solicitors have been eagerly awaiting the outcome of this report. We believe the reports findings will have a positive impact in allowing the Courts deal with medical negligence claims* proactively and compassionately.

The Report can be accessed here, and details 17 recommendations which we summarize as follows:

- Actions, practices and procedures must be introduced to reflect that medical negligence claims* involve issues not arising in other personal injury claims*;

- Pre-action protocols are to be implemented, together with the commencement of the provision extending the Statute of Limitations period for medical negligence claims* from two years to three years;

- Procedures allowing for the case management of medical negligence claims* are to be implemented;

- That there should be a dedicated list in the High Court to deal with the management and hearing of medical negligence claims*;

- That medical records, when requested, are provided in a timely way and in a legible form;

- That failure to comply with the requirements of pre-action protocols should be penalized with costs or, in cases of persistent non-compliance, an order to dismiss the claim or defence;

- The amending of Section. 26 of the Civil Liability and Courts Act 2004 is recommended in order to provide for sanctions where a defendant files a defence containing matters in respect of which there is no supportive expert report.

- The Expert Group does not recommend the introduction of a no-fault system to deal with certain clinical negligence claims*;

- The establishment of a compensation scheme to deal with certain vaccine damage medical negligence claims*;

- The Expert Group does not recommend the establishment of a Medical Injuries Assessment Board (MIAB), similar to that of the Personal Injuries Assessment Board, which was established to deal with personal injury claims*.

- That a system for the “restoration of trust”, as provided for in Chapter 5 of the CervicalCheck Tribunal Act 2019 be made available for other clinical negligence claims*;

- Ex gratia payment schemes only have limited application;

- That care packages provided by the HSE be funded so as to reduce the difference between what the HSE can offer and what a court would award;

- That the disclosure of certain patient safety incidents be made mandatory;

- That failure to make a disclosure, when required by law to do so, should be considered to be either professional misconduct or poor professional performance by the healthcare provider involved, and should be the subject of an inquiry by the relevant professional body;

- It should be a criminal offence for a healthcare provider: – (i) to deliberately fail to make a disclosure of a serious reportable patient safety incident when required by law to do so; (ii) to alter medical records with the intent to mislead or deceive;

- That the provisions of the Health Act 2007 be amended so as to enable HIQA to carry out investigations other than those currently provided for.

Extension of the Statute in Medical Negligence Claims* and Pre-action protocols

One of the major findings of the report is the need to establish pre-action protocols in medical negligence case*. This, together with the extension of time limits under the statute of limitations would certainly be welcomed by our medical negligence solicitors*. Efficient and speedy reforms are now needed to bring these recommendations to fruition, in order to achieve additional effectiveness in the management of complex medical negligence claims. The protocols encourage co-operation and provide for the narrowing of issues in dispute between the parties. However, in order for the protocols to work effectively, it is also important for the parties to be compelled to address the issue of quantum in a meaningful way at the pre-action stage which in turn will allow for realistic offers of settlement much earlier in the life of the claim.

The Admission of Witness Statements in Medical Negligence Claims*

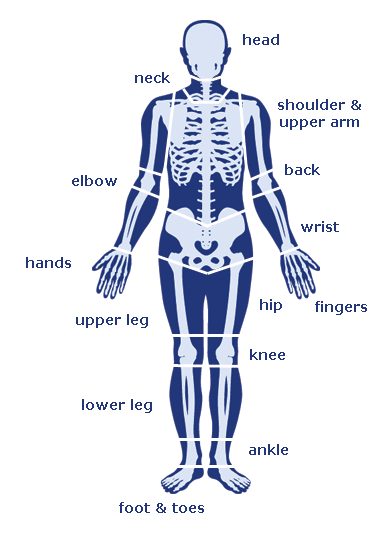

The Report also recommends the provision of witness statements in medical negligence claims*. This will avoid claimants having to give evidence of a personal or intimate nature in open court. The Report posits that the adversarial aspect of a court hearing could be confined to resolving disputes between suitably qualified experts. This practice is already accepted in a number of common law jurisdictions, where they can play a crucial role in a case. The provision of witness statements allows advance notice of the evidence to be relied on at a clinical negligence claim* trial, resulting in better prepared experts.

The Report suggests that the use of witness statements could potentially remove the need for the claimant to give evidence in court unless he or she wishes to do so, but it is more likely that such statements would only replace the evidence-in-chief of the witness. The medical negligence lawyers for each party would still to retain the right to cross-examine their opponent’s witness, in order to “test” the cogency of the evidence and the witness’s credibility. In such circumstances, the claimant would still have to submit to cross-examination on his or her evidence.

Case management of Medical Negligence Claims

The Expert Group recommended the implementation of the excellent case management proposals set out in the report of the Working Group on Medical Negligence and Periodic Payments (Module 3) which, the Expert Group say, would considerably improve the current system to the benefit of the litigants involved. However, The Expert Group also notes that, “whilst proposed rules have been circulated for the implementation of pretrial protocols and a Statutory Instrument is being drafted, there has been no such progress in the introduction of case management”.

Case management is an essential tool for medical negligence solicitors and lawyers for the purposes of controlling lengthy, complex and potentially unwieldy medical negligence, including GP negligence or hospital negligence claims.

Hanahoe and Hanahoe solicitors are an award-winning solicitors firm, with over 40 years’ experience in dealing with complex medical negligence claims*. If you have a query about a possible medical negligence claim*, please contact our office to speak with one of our medical negligence solicitors* today.

*In contentious business a solicitor may not calculate fees or other charges as a percentage or proportion of any award or settlement.